Filing your 2020-21 Form 2290 doesn’t have to be confusing or time-consuming.

With ExpressTruckTax, you can file your 2020-21 Form 2290 in three simple steps and get back on the road in minutes. Plus, with our cloud-based software, you can file from anywhere — even the cab of your truck.

Learn how to file your 2020-21 Form 2290 in just three steps.

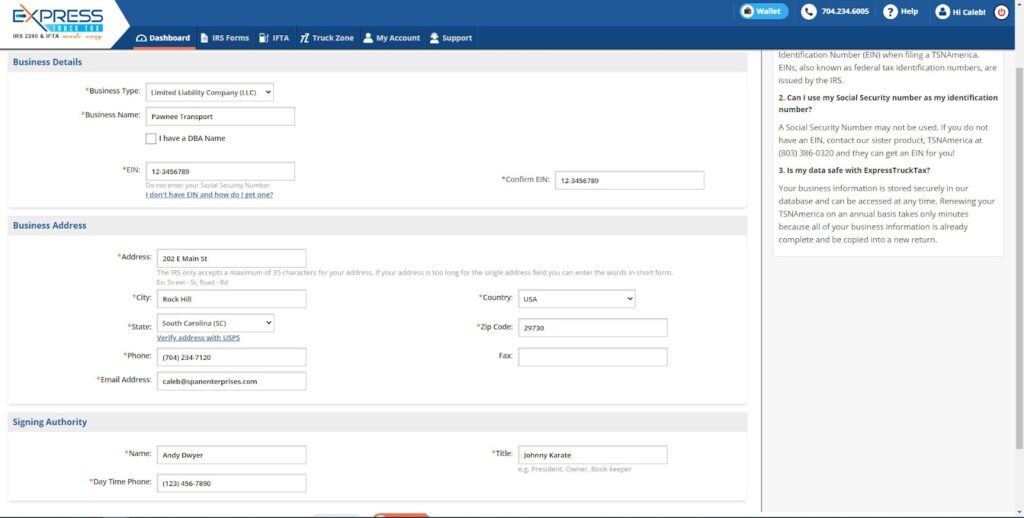

Step 1: Enter your business information

Once you create your free ExpressTruckTax account, you will need to enter your business information to get started with your Form 2290 filing.

You will need the following business information:

- Employer Identification Number (EIN) – Why do you need EIN?

- Business Name

- Business Address

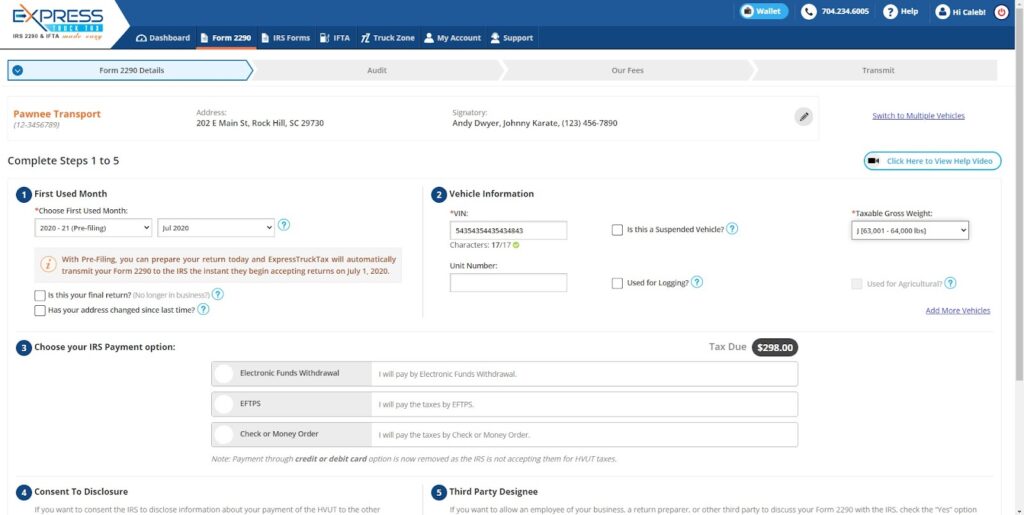

Step 2: Enter your truck information

Once you have completed your business information, start a new return, and then enter your truck information. This will also be used to populate your Form 2290.

You will need the following truck information

- First use month

- Vehicle Identification Number (VIN)

- Taxable Gross Weight – Not sure about taxable gross weight?

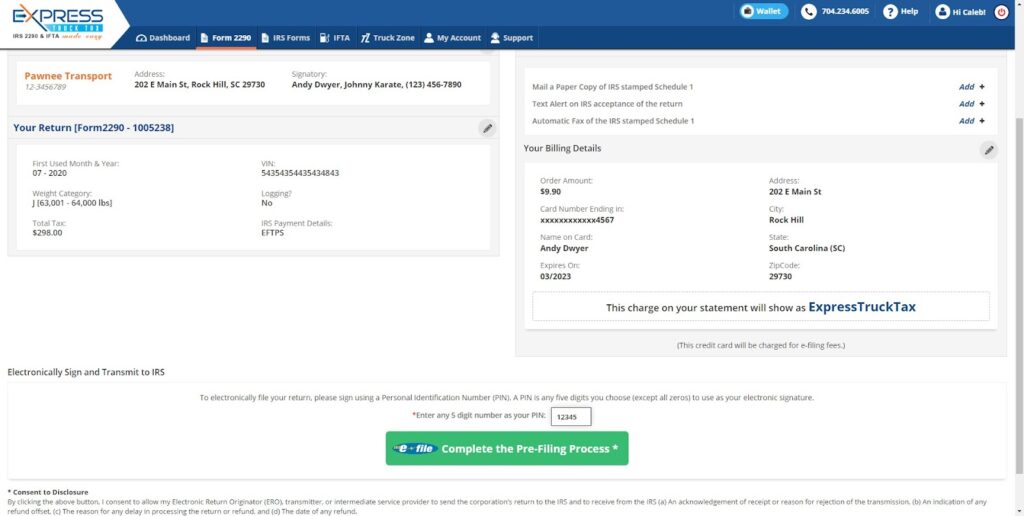

Step 3: Transmit your Form 2290 to the IRS

Finally, you will select your HVUT payment method, let the system check for errors, and transmit your return to the IRS. You will receive your Stamped 2290 Schedule 1 back from the IRS in a matter of minutes! ExpressTruckTax will also send your Stamped Schedule 1 to your carrier if you want.

Ready to File 2020-2021 Form 2290 with ExpressTruckTax?