The IRS has changed Form W-4 for 2020. You might not think the change will affect you, but it almost certainly will.

So how could the new 2020 W-4 affect the trucking industry?

Let’s cover the 2020 W-4 in detail so you understand what the IRS has changed and why it matters to you.

What is the 2020 Form W-4?

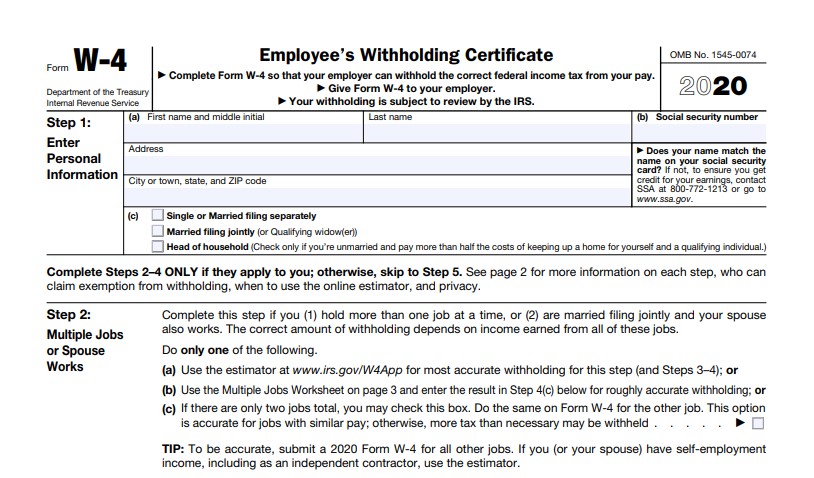

The IRS Form W-4 was designed for employees to report tax information to their employers. This includes information like income, deductions, marriage status, and withholding information.

All of this enables employers to accurately withhold taxes from their employee payroll. This money goes to Medicare, Medicaid, and Social Security.

Who needs the 2020 Form W-4?

Every new employee hired in 2020 is required to fill out the 2020 Form W-4. Even if you have been working for 40 years and you change jobs, you will be required to fill out a new Form W-4.

The Form W-4 is also used to report changes in information for existing employees, such as marital status or additional dependents.

What’s new on the 2020 Form W-4?

The 2020 Form W-4 is actually shorter than the previous versions. This is partly because the IRS was attempting to simplify the form (not that they really did), and partly because they entirely removed one section on the 2020 W-4.

This section removed from the 2020 W-4 was called the “Personal Allowance Withholding Worksheet”. This section was made irrelevant when the IRS did away with personal allowances.

How the new 2020 W-4 is laid out

- Step 1= Personal information

- Step 2= Income information from you and your spouse

- Step 3= Claim your dependents

- Step 4= Other income you want to record

- Step 5= Employee’s signature

The best solution for creating 2020 Form W-4

If you’re a trucking employer, you will need to use the new 2020 W-4 every time you hire a new employee. For many employees and employers, the form can be difficult to fill out correctly.

The simplest and most affordable solution is to use the new 2020 W-4 Form from TaxBandits.

With TaxBandits, you can email your employees a W-4 for them to fill out electronically with step-by-step instructions. That form can then be printed or saved for filing your taxes.

Give TaxBandits a try today!