Filing Form 2290 doesn’t have to be a confusing process. If you know some simple things ahead of time, filling out, sending, and paying your tax won’t be difficult!

These simple HVUT filing tips could also help you save time and avoid common errors that could lead to Form 2290 rejection and delays.

So don’t file until you check out these HVUT filing tips!

HVUT Filing Tips for 2020-2021 Tax Period

1. Know your HVUT deadline

This is one of the most important HVUT filing tips. Your 2020-2021 HVUT deadline will be based on the month you first used your vehicle.

You must file and pay your Form 2290 by the end of the month following the month of first use. So if you started using your vehicle in May, you will need to file your HVUT by June 30. Know more about the 2290 deadline.

2. Gather required information

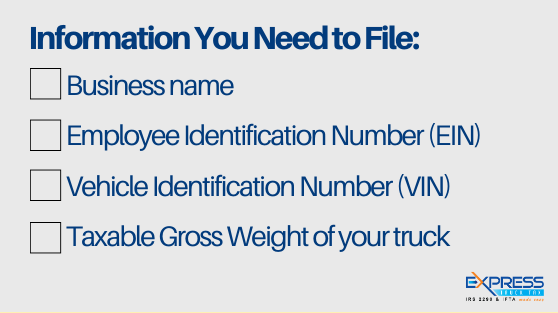

You’ll need to pull together all your business information when you file your 2020 Form 2290. To help you get everything together, here’s a handy checklist:

Access this link for detailed information about the required Form 2290 information.

3. Decide how to pay your HVUT taxes

When it comes to paying your HVUT taxes, you have some options. You can choose to pay your HVUT taxes by EFW, EFTPS, Check, or Money Order.

If you choose Electronic Funds Withdrawal (EFW), you must provide your bank account information to the IRS, and they will automatically withdraw your payment from your account.

If you choose the Electronic Federal Tax Payment System (EFTPS), you will need to enroll in the EFTPS system and create an account. You can then use that account to enter payment information and make your tax payment.

Gain more info about HVUT payments, with this helpful article from ExpressTruckTax.

If you choose to pay by Check or Money Order, you must mail in your payment to the IRS with a copy of 2290-V from page 11 of the Form 2290. Mail your payment and voucher to:

Internal Revenue Service,

P.O. Box 932500,

Louisville, KY 40293-2500

4. E-file your Form 2290 for an instant Schedule 1

You could fill out your Form 2290 on paper and send it in. But why would you risk making mistakes and delay receiving your Schedule 1 when you could e-file your 2290?

ExpressTruckTax has a built-in audit system that checks for common Form 2290 errors and we will instantly transmit your 2290 to the IRS. That means you will typically get your stamped Schedule 1 back in a matter of minutes!

Get started with market-leading e-file provider ExpressTruckTax and e-file today!