ExpressTruckTax just got a facelift.

Our apps have always been user-friendly and easy-to-use, but now it’s even easier (and prettier, if you ask us).

With tax season in full force, you’ll need all the help you can get! Remember, you only have until August 31st to get those 2290’s done.

When you e-file with ExpressTruckTax, either through our website or our new and improved apps, you can get your 2290’s securely transmitted to the IRS in just under 10 minutes. And once you’re done and you’ve transmitted your return, you’ll get your Stamped Schedule 1 emailed directly to you!

You can e-file anywhere and anytime. No matter where you are, if you have your smartphone (or tablet), you can e-file.

Whether you’re waiting in line on your lunch break, sitting in the shade in the park, or having a cup of coffee at a truckstop, if you’ve got 10 minutes, you can e-file!

|

| Jair relaxing on a bench and e-filing his 2290. |

With just three simple steps, ExpressTruckTax can help you file your 2290 and get right back to your life. No muss, no fuss, just a great product and superior e-filing.

How to E-file On-the-Go

To e-file with our new apps in a flash, all you need to do is follow three simple steps!

Account Setup

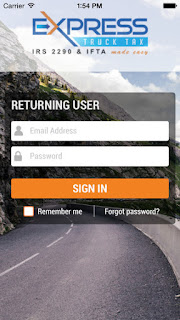

- If you’ve never filed with us before, then you’ll need to set up your account. In order to do this, simply select “create new account” or choose to login with your Google+ or Facebook account.

- If you’re a returning user, simply enter your information and login.

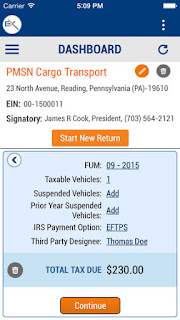

- Now you can enter in your business details and your EIN number. Again, if you’ve filed with us previously, you can simply use the same business details and EIN that you filed with last year.

- Then choose to file for the current year and move on to step two!

Vehicle Details

- After you’ve entered your business information and selected to file for the current tax year, the next step is to enter the information for your vehicle or vehicles.

- You can do this in a number of different ways. You can import them from a CSV file, you can enter them in manually, or if you’ve filed with us previously, you can import them from your virtual garage in TruckZone.

- Pro-tip: There are three different kinds of vehicles you can enter. Make sure you’re entering them all on the right screen or you may have to file an amendment (and owe the IRS more money).

- At the end of this step you can enter in any low mileage credits, and then quickly and easily move on to step 3!

Pay & Transmit

- The final step in the e-filing process is to pay and securely transmit your return to the IRS.

- Simply select your payment method from the three types the IRS accepts: Direct debit, EFTPS, and check or money order. Then review your information and securely transmit your return to the IRS.

- Your Stamped Schedule 1 will follow any minute. It’s just that easy!

If you have any questions or need any help through the e-filing process, our support legends are here for you. Our USA-based support team is ready to help you around the clock! You can reach them by phone during our new extended hours from 8AM to 8PM EST or by email day and night.