There is one big secret to avoiding IRS HVUT penalties on your Form 2290: filing on time.

The 2020 Form 2290 is August 31, 2020. You need to file before midnight on August 31st to avoid 2290 penalties!

What are the 2290 penalties?

If you miss the deadline, you will incur a penalty equal to 4.5% of the total tax amount you would have owed. Plus, for each additional month, you are late, you will incur another .5% in interest.

That might not sound like much, but don’t forget, failing to have a current stamped Schedule 1 will impact your other licenses. You need a current stamped Schedule 1 to stay up-to-date on most licenses. If you don’t file Form 2290, you could end up being grounded. And if you can’t drive, you can’t make money.

Access our helpful resource to know more about HVUT 2290 penalties.

Here are some Frequently Asked Questions about 2290 Penalties.

- I transmitted my return by 11:30 PM. Will I face a penalty if the IRS accepts my return after midnight?

- How do I pay the 2290 penalty?

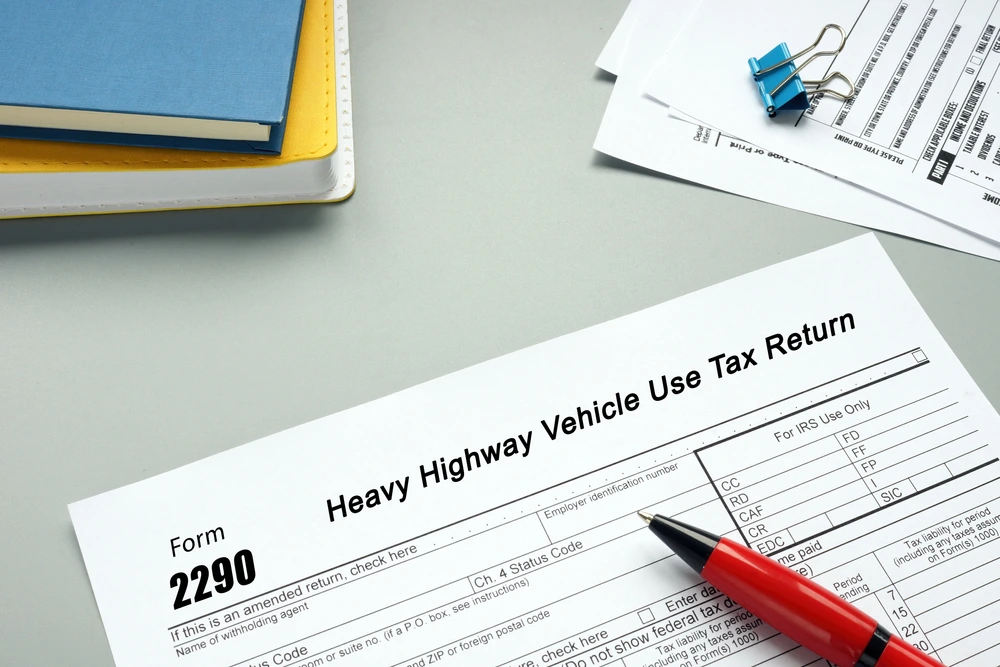

File Form 2290 today with ExpressTruckTax in Minutes

Filing with ExpressTruckTax is simple and secure and you can do file from anywhere! Our software is cloud-based and fully compatible with mobile devices.

Plus, if you have filed with us before, our Ready Return feature makes it possible for you to copy the details from a previous return with a single click.

All your saved business and vehicle information will auto-populate your Form 2290 for 2020 automatically. All you have to do is update your IRS payment information and transmit your return to the IRS.

And with our ExpressGuarantee, you will receive your stamped Schedule 1 or your money back!

Get Started Now with ExpressTruckTax