The 2020 Form 2290 deadline was August 31! If you entered the wrong VIN on your return, we’ve got you covered!

We know paperwork isn’t the most interesting thing in the world. When you sit down to fill out forms sometimes it’s easy to get distracted and make mistakes. That’s why ExpressTruckTax offers free Form 2290 VIN corrections to our clients.

Here’s what you need to know to correct your VIN after the deadline.

What’s My VIN?

Your VIN is your vehicle identification number. It’s a 17-character-long combination of numbers and letters in a font that is usually small and hard to see.

Therefore, unfortunately, it’s incredibly easy to make typos when entering your VIN on your Form 2290. If you put the incorrect VIN on your 2290 now, there will be hassles and headaches with the DMV later.

ExpressTruckTax wants to save you that trouble. That’s why we work with the IRS as a trusted and secure source to offer free Form 2290 VIN corrections to our clients. And you’ll get your Stamped 2290 Schedule 1 in a matter of minutes.

Why do I need to correct my VIN on Form 2290?

If you accidentally file your Form 2290 with an incorrect VIN, it will cause problems down the line. Since the VIN on the return doesn’t match the VIN on your truck, the DMV and carriers will not accept your stamped Schedule 1.

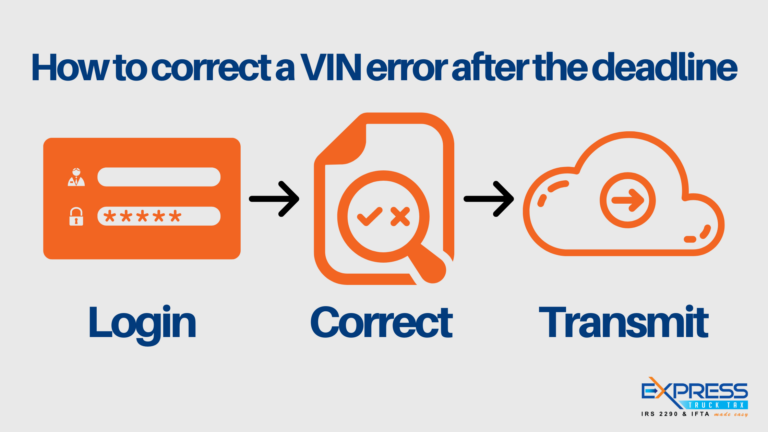

How do I make a Form 2290 VIN correction?

E-filing a Form 2290 VIN correction is incredibly simple. All you need to do is sign-in to your account and click “Start New Return” then click the “Form 2290 Amendments” option to complete your free VIN correction.

*If you did not file your 2290 with ExpressTruckTax, you can still make a VIN correction, it just will not be free.

Then, simply fill out the Form 2290 VIN correction information and transmit your form to the IRS. You can resubmit your forms as many times as necessary to make VIN corrections for free. The next step is to relax because you’ll receive your updated 2290 Schedule 1 in a matter of minutes!

However, keep in mind that VIN corrections can only be made for taxable and suspended vehicles. They can’t be made for credit vehicles or for prior year suspended vehicles. Also, when filing a free VIN correction you can’t combine it with credits that have been claimed on the same form.

Remember that the original form with the incorrect VIN on it must be paid for by the due date before you submit a correction or the IRS will assess penalties on top of the tax that you actually owe.

E-Filing 2290 VIN Correction With ExpressTruckTax

There’s no way around it, you have to file your taxes. Form 2290 isn’t going anywhere. So, why not make the process of filing your taxes and returns incredibly easy with ExpressTruckTax?

When it comes to Form 2290 Filing we offer step-by-step instructions. Plus you’ll receive your Stamped Schedule 1 by email in a matter of minutes. You can also submit free VIN corrections when you file with us.

Plus, we have an outstanding local support team that’s always standing by to answer your questions. If you need any help please don’t hesitate to contact us via phone or email.