Accountants who use ExpressTruckTax can get some pretty great perks, including being able to e-file for their clients quickly through our easy e-filing software. You won’t find another product where you can e-file for your client in under 10 minutes.

If you’re tired of paper-filing or playing the waiting game for your clients to sign and fax back Form 8453-EX, we have solutions for all of these problems. Setting up your account as a tax preparer with ExpressTruckTax is easy, and as always, we’ve added shortcuts to streamline the process and help simplify your business.

All you need to do is follow three simple steps!

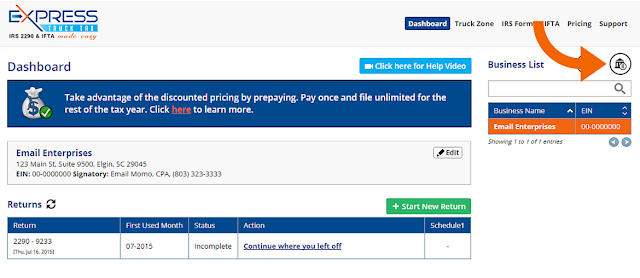

CPA Account Setup

- If this is your first time using ExpressTruckTax, then go ahead and create an account and make sure you specify that you are a CPA.

- If you’ve created an account, simply log in and go to your dashboard.

- Now all you need to do is enter your accounting firm details and your EIN number.

E-file For Your Client

The next step is to e-file a Form 2290 for your client. With ExpressTruckTax, the whole process from start to finish is very easy.

Step 1: Enter Client’s Account Details

- Enter their name, business details and, EIN number.

- Choose to file for the current year

Step 2: Enter Client’s Vehicle Details

- You can do this in a number of different ways. You can import their vehicles from a CSV file, you can enter them in manually, or you can import them from their virtual garage in TruckZone.

- Don’t forget any low mileage credits.

Step 3: Client’s Payment Details

- The final step in the e-filing process is to pay and securely transmit their return to the IRS.

- Simply select their payment method from the three types the IRS accepts: Direct debit, EFTPS, and check or money order. Then review their information and move on to the next step. This is where you will encounter Form 8453-EX.

E-File in High Gear: Use the Bulk Upload Options

Alternatively, you can bulk upload business details for all of your clients in one fell swoop! It works in the same way that bulk uploading your client’s trucks from an excel file does. And yet again, you can do this in three simple steps!

Step 1: The Excel File

- Login to your account and under new to business list, select manage businesses

- Then, on the manage businesses screen, select “Bulk Upload Businesses”

- A screen prompting you to download our excel template will appear, select to download the template and move on to step two!

Step 2: Enter Businesses

- Now in the excel file you need to enter your client’s businesses and a few details, including their EIN, phone numbers, fax numbers, and addresses.

Step 3: Upload File

- Now all you need to do is upload the file to your ExpressTruckTax account. The rest of the work is done for you!

- If there are any errors, our system will catch them and let you know on a case-by-case basis what type of error it is and what you need to do to fix it.

- Then voila! You have all of your clients uploaded.

And that’s all there is to it! when you encounter the Form 8453-EX, all you have to do is send it to your client via your tax portal to be e-signed, by email, or by fax, and then you can securely transmit your client’s return. Then you’re done!

If you need any help during the e-filing process, or you encounter any problems, we’re here for you! Our dedicated support legends can answer all of your heavy vehicle use tax and ExpressTruckTax-related questions with ease.

So give them a call at 704.234.6005 during our new extended business hours from 8AM – 8PM EST or send them an email at support@expresstrucktax.com for 24/hour support in English and Spanish.