The trucking industry is undergoing a transformative shift, with hybrid and electric trucks emerging as innovative, eco-friendly alternatives to traditional diesel-powered vehicles. These vehicles are helping to reduce fuel consumption, lower emissions, and comply with increasingly stringent environmental regulations. As businesses strive to embrace sustainability and align with government incentives for greener operations, hybrid and electric trucks are gaining traction as a viable solution for both small and large fleets.

However, alongside these advancements come a host of new opportunities and challenges, particularly in the realm of taxes and compliance. Understanding how federal tax laws, like the Heavy Vehicle Use Tax (HVUT), apply to hybrid and electric vehicles is essential for truck owners and fleet operators. One key document that governs these tax obligations is Form 2290, the IRS form required for heavy vehicles operating on public highways.

While hybrid and electric trucks may differ significantly from their traditional counterparts in terms of technology and environmental impact, they are not exempt from certain tax requirements. This guide provides an in-depth explanation of what truck owners and operators need to know about filing Form 2290 for hybrid and electric trucks, ensuring compliance while taking advantage of potential exemptions, credits, and state-specific incentives.

The Rise of Hybrid and Electric Trucks in the Trucking Industry

Hybrid and electric trucks represent a growing segment of the trucking industry, driven by advancements in battery technology, a push for cleaner energy, and the need for more sustainable transportation solutions. These vehicles rely on alternative energy sources, such as rechargeable batteries or a combination of internal combustion engines and electric motors, to power their operations.

Key benefits include:

- Reduced Operating Costs: Lower fuel consumption and fewer maintenance requirements.

- Environmental Impact: Significant reductions in greenhouse gas emissions.

- Compliance with Regulations: Alignment with local and federal environmental mandates.

Despite their benefits, these vehicles come with unique considerations, including higher upfront costs and specific tax implications, which make understanding their Form 2290 requirements critical.

What Is Form 2290 and the Heavy Vehicle Use Tax (HVUT)?

Form 2290 is a federal tax form used by the IRS to collect the Heavy Vehicle Use Tax (HVUT). This tax applies to vehicles weighing 55,000 pounds or more and is primarily used to fund highway maintenance and infrastructure improvements across the United States.

While hybrid and electric trucks represent a shift toward cleaner energy, they are not exempt from HVUT requirements if they meet the weight and mileage thresholds. However, these vehicles may qualify for certain exemptions or reductions, depending on federal and state incentives.

Do Hybrid and Electric Trucks Need to File Form 2290?

Yes, hybrid and electric trucks must file Form 2290 if they meet the following criteria:

- Weight: The truck’s gross vehicle weight (GVW) exceeds 55,000 pounds.

- Mileage: The vehicle travels more than 5,000 miles annually on public highways (or 7,500 miles for agricultural vehicles).

Even though these trucks are considered eco-friendly, their usage on public roads still makes them subject to HVUT. Owners must be diligent about understanding their filing obligations to avoid penalties and ensure compliance.

Calculating HVUT for Hybrid and Electric Trucks

The HVUT calculation for hybrid and electric trucks follows the same methodology as traditional vehicles. The primary factors include:

- Gross Taxable Weight: Vehicles weighing 55,001 pounds or more are taxed on a sliding scale. The tax increases as the weight rises.

- Mileage: If a vehicle is driven fewer than the specified mileage thresholds (5,000 miles for standard vehicles and 7,500 for agricultural vehicles), it can be classified as a suspended vehicle. While you must still file Form 2290, no tax payment is required in these cases.

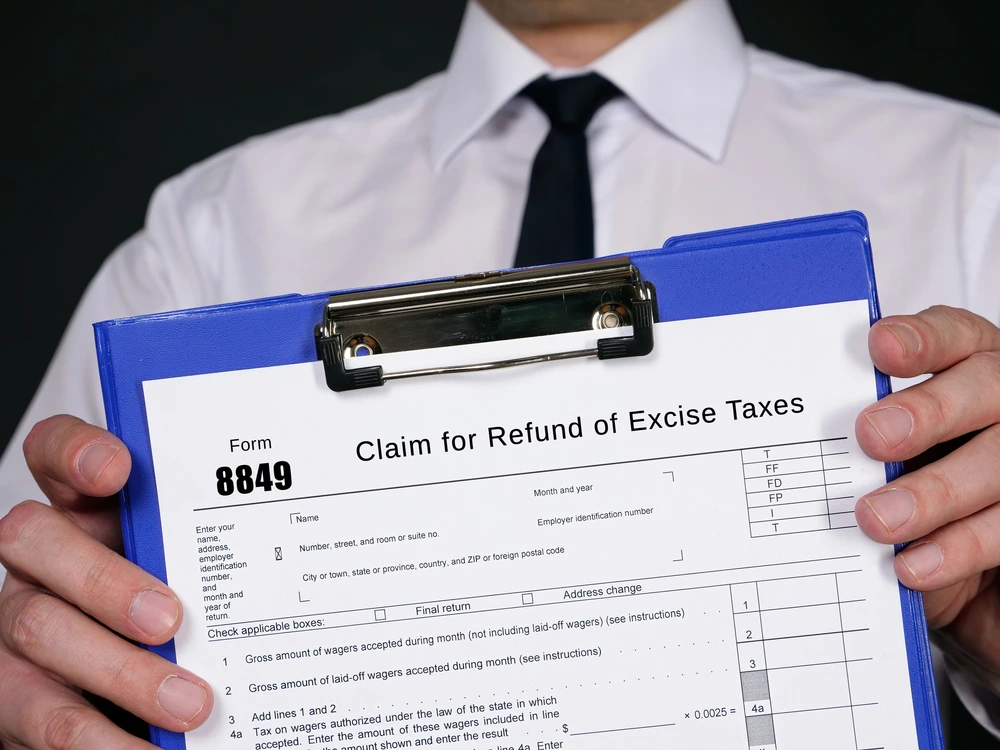

Tax Credits and Incentives for Hybrid and Electric Trucks

Hybrid and electric truck owners may qualify for various incentives that reduce their overall tax liability, even if they are required to file Form 2290. These include:

- Federal Tax Credits: Owners may be eligible for federal credits designed to encourage the adoption of green technology.

- State-Specific Incentives: Many states offer additional rebates, credits, or reduced HVUT rates for vehicles that meet eco-friendly criteria. It’s essential to check with your state’s transportation or tax department for details.

While these incentives don’t eliminate the need to file Form 2290, they can significantly reduce the financial burden.

Filing Form 2290 for Hybrid and Electric Trucks

Here’s a step-by-step guide to filing Form 2290:

- Determine the Filing Deadline:

- The annual deadline for filing Form 2290 is August 31.

- For newly purchased vehicles, you must file by the end of the month following the month of first use on public highways.

- Collect Vehicle Information:

- Vehicle Identification Number (VIN)

- Gross taxable weight

- Mileage records

- Choose E-Filing for Speed and Convenience:

- The IRS encourages e-filing for faster processing, especially for fleets or businesses managing multiple vehicles. E-filing ensures quicker confirmation and reduces the likelihood of errors.

- Understand Exemptions and Suspensions:

- If your hybrid or electric truck qualifies for an exemption (e.g., low mileage), you must still report it on Form 2290 but may not owe any tax.

Environmental and Regulatory Impacts of Green Trucks

Hybrid and electric trucks represent a commitment to sustainability by reducing reliance on fossil fuels and cutting emissions. Many states have enacted stricter emissions regulations, making these vehicles a popular choice for environmentally conscious fleet owners. However, compliance with Form 2290 and HVUT requirements remains critical for keeping your fleet operational.

Future Changes to HVUT for Green Trucks

As the adoption of hybrid and electric trucks grows, policymakers may introduce changes to HVUT regulations to accommodate these advancements. Potential updates could include:

- New Exemptions: Specific allowances for eco-friendly vehicles.

- Lower Rates: Adjustments to reflect the reduced environmental impact of green trucks.

Staying informed about these developments will help truck owners optimize their tax strategy and remain compliant with evolving regulations.

Why Filing Form 2290 Matters

Timely filing of Form 2290 ensures compliance with federal tax laws and avoids penalties or interest charges. Additionally, proof of payment is required to renew vehicle registrations, making it essential for keeping your fleet running smoothly.

Simplify Your Form 2290 Filing with ExpressTruckTax

Managing Form 2290 requirements for hybrid and electric trucks doesn’t have to be complicated. At ExpressTruckTax, we make the process fast, accurate, and stress-free. Here’s why thousands of truckers trust us:

- Instant Stamped Schedule 1: Receive proof of payment within minutes.

- Error-Free Filing: Automatic error checks reduce the chance of IRS rejections.

- Free VIN Corrections: Quickly amend errors without additional fees.

- Bilingual Support: Access expert help in English or Spanish.

- Mobile Filing: File from anywhere using our mobile app.

Whether you’re filing for a single vehicle or an entire fleet, ExpressTruckTax is your trusted partner for all Form 2290 needs. Visit ExpressTruckTax today to get started and keep your green trucks rolling!