Do you need to transfer your 2290 in a hurry? If you swapped vehicles or purchased a new one last month, then the answer is yes!

Vehicles first used in one month have a 2290 filing deadline at the end of the next month!

Even though that’s no time at all, it’s still plenty of time to transfer your 2290.

That’s because it only takes about 10 minutes to E-file a Form 2290. So if you’ve recently swapped vehicles, it’s time to get in gear and get yourself E-filed before the deadline.

Here’s the Game Plan:

1. E-file a new Form 2290

2. Claim a Credit Vehicle on that form

3. Receive your new Stamped Schedule 1 via email instantly

That’s all it takes to “transfer” your 2290 from your old vehicle to the new one. Want to see it step-by-step? I thought so, here’s the Play-by-Play.

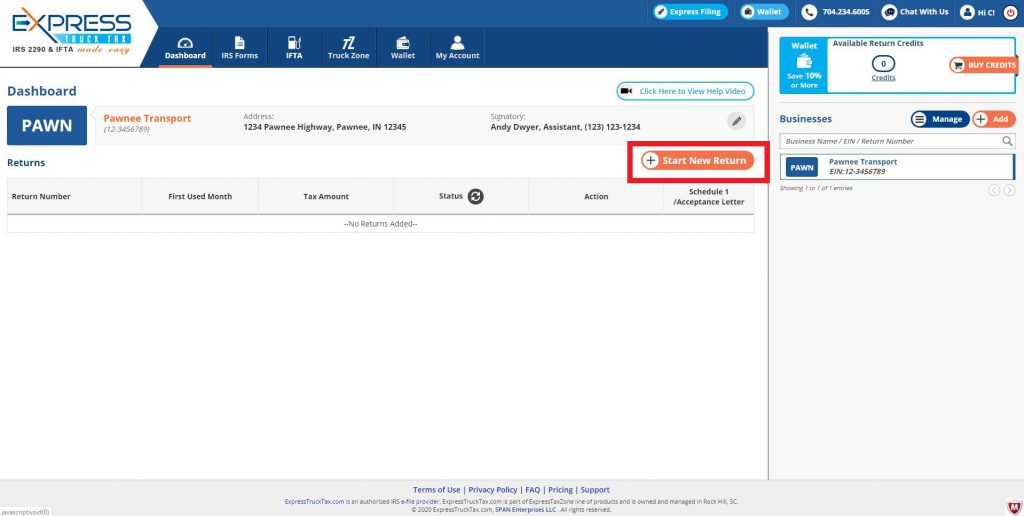

1: Login or create an account (it’s free!). If you’re new to ExpressTruckTax, quickly enter your name, business info, and EIN before you begin E-filing. Finally, click “Start New Return,” choose a Form 2290, and then enter your first-used month (the month in which you purchased the new vehicle).

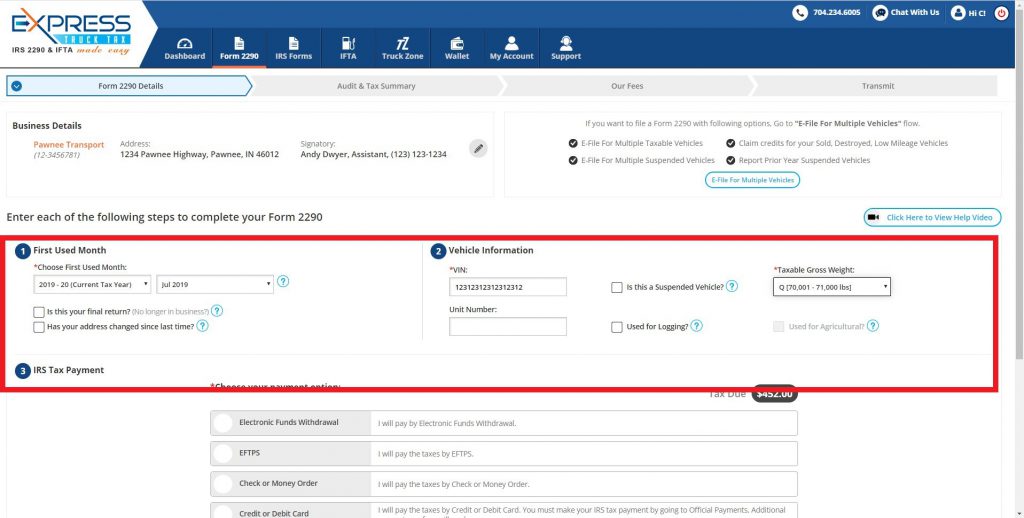

2: Now to enter your taxable vehicle information (for the new truck). Simply input the VIN, gross weight, and select whether the vehicle is used for logging. Save and then skip the next few screens.

Step 3: It’s time to enter your Credit Vehicle. This is how you receive a prorated refund on the HVUT tax previously paid. Click +Add a Credit Vehicle, enter the VIN & gross weight, then enter details of the “loss event.” This means choosing the date on which the vehicle was sold, lost, or destroyed, as well as uploading any required evidence, like a bill of sale. And that’s it. Simply input your payment method, and then hit the big green Transmit button. Within about 10 minutes, the IRS will have reviewed you return, and if it’s accepted (98% of returns E-filed with us are!), then you’ll receive your new stamped Schedule 1 via email immediately.

Bonus Tips: More Ways to Save

- If your previous truck was sold, stolen, or destroyed, and you are choosing not to replace it, then you can still get a prorated refund of the HVUT you paid! The procedure is different from the “transfer” process. To claim a prorated refund in this case, simply E-file a Form 8849. We offer easy E-filing of this form too, check out these tips on how to file your 8849 fast.

- If your business name or EIN has changed, then you can also get a prorated refund for the taxes paid under the previous name/EIN. Just E-file a new Form 2290 for all vehicles under this new name or EIN. Then E-file a Form 8849 under the old name/EIN to get some of those tax bucks back.

Ready to transfer?

Still have questions about transferring your 2290 or claiming your refund?

That’s what our Support Team is for! They’re ready to lend a helping hand to E-filers in distress, 24/7.

Call them at 704.234.6005 or shoot them an email 24/7 at support@expresstrucktax.com.

They’ll help you cross the E-filing Finish Line before the deadline, guaranteed.