It’s no secret that truckers have a ton of trucking taxes to keep up with. Whether you work for a large company like Schneider, Mercer, or XPO Logistics, or you are an independent owner-operator, you may be required to file the annual IRS Form 2290.

One of the many reasons truck drivers and fleet managers choose ExpressTruckTax to file IRS Form 2290 is because of the time-saving feature called Copy Previous Return! This feature lets you quickly and easily file your Form 2290 for the current tax year by copying information from your previously accepted return.

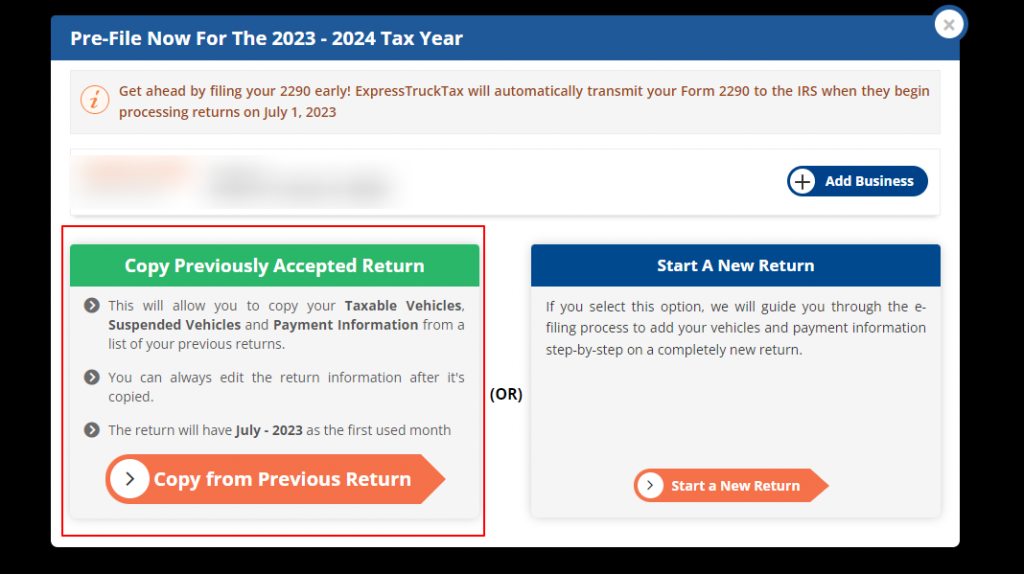

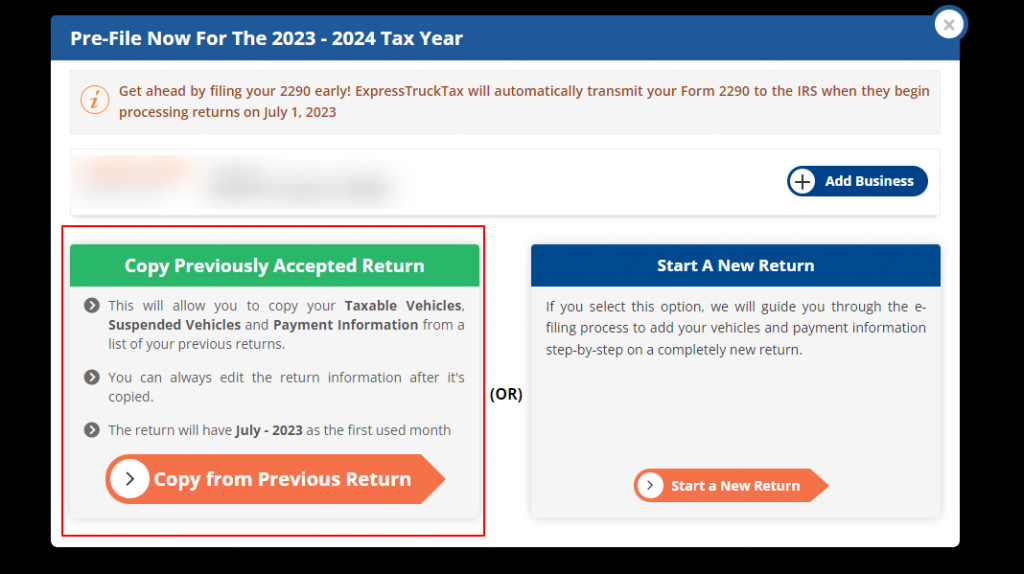

Here’s how the 2290 Copy Return Feature works:

- Log in to your ExpressTruckTax account.

- Click the orange button that says, Pre-file 2023

- Choose ‘Copy Previously Accepted Return’

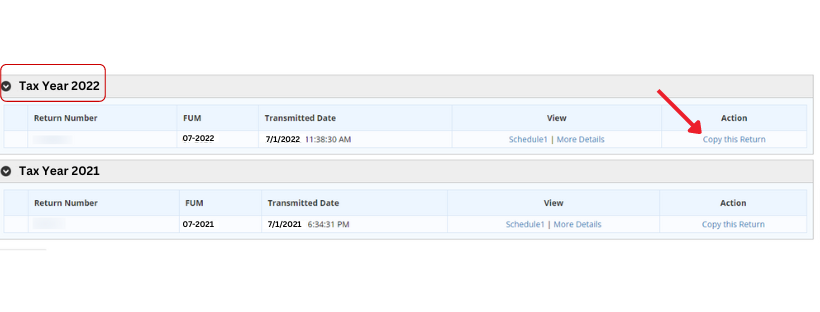

- Locate the most recent Form 2290 that you filed and click ‘Copy this Return’

- ExpressTruckTax will automatically populate your 2023-24 IRS Form 2290 with the information from your previous return, including your business name, EIN, and VINs.

- Review the information to make sure everything is accurate and up-to-date.

- Edit any information, such as your business name or EIN.

- Edit or enter any new vehicles or update any information that has changed since your previous return.

- Transmit your return to the IRS! Your return will be ‘On Hold’ until the IRS begins processing these returns in the first week of July 2023.

Save valuable time with this IRS Form 2290 feature:

By using the “Copy Previous Accepted Return” feature in ExpressTruckTax, you can save time and avoid having to enter all of your information manually each year. This feature is especially useful if you have a large fleet of vehicles and need to file multiple returns each year.

More time-saving features you’ll love from ExpressTruckTax:

In addition to the “Copy Previous Accepted Return” feature, ExpressTruckTax offers a variety of other tools and features to make filing your Form 2290 easy and stress-free.

From free VIN corrections to automatic email notifications, ExpressTruckTax is designed to help truckers stay compliant with the IRS and keep their businesses running smoothly.

What are you waiting for?! Log in to your ExpressTruckTax account and file your 2023-24 Form 2290 today!