As a responsible truck owner-operator, it is essential to stay compliant with the IRS regulations by filing your Heavy Vehicle Use Tax (HVUT) Form 2290 accurately and promptly. However, this task can be daunting and time-consuming. Fortunately, with the assistance of ExpressTruckTax, the number one IRS-authorized e-filing solution, the process becomes incredibly efficient. In this blog, we’ll walk you through the streamlined steps to file your Form 2290 quickly and hassle-free with ExpressTruckTax.

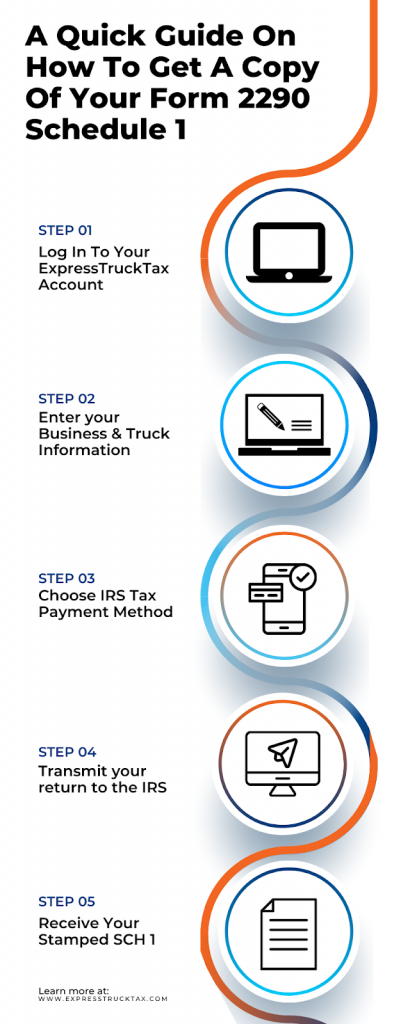

Step 1: Register or Log in to your ExpressTruckTax Account

Begin by creating an account with ExpressTruckTax if you’re a first-time client or log in if you already have an existing account. We offer a simple and intuitive registration process, requiring only basic information to set up your account.

Step 2: Choose your Filing Period and Enter Vehicle Information

Select the tax year and the appropriate tax period for which you need to file your Form 2290. Typically, the tax year for Heavy Vehicle Use Tax runs from July 1st to June 30th of the following year. Choose whether you are filing for the current tax year or a previous tax year. You’ll also need to enter the required details about the vehicles you report on Form 2290. You’ll need information like the Vehicle Identification Number (VIN), taxable gross weight, and the first-used month of each vehicle during the tax period.

Step 3: Calculate Your HVUT and Choose Your IRS Payment Method

Once you have entered all the necessary vehicle details, ExpressTruckTax will automatically calculate the Heavy Vehicle Use Tax for each vehicle based on the provided information. We ensure accurate calculations, minimizing the risk of errors and potential IRS penalties. Next, select your preferred payment method to pay the calculated HVUT amount to the IRS. ExpressTruckTax, drivers and fleet managers can simplify the HVUT payment process and streamline their tax compliance responsibilities by choosing to pay the IRS tax due via credit card.

Step 4: Transmit to the IRS

After verifying all the information, review your Form 2290 for accuracy. Once you are confident that everything is correct, transmit your form directly to the IRS using our secure e-filing system. ExpressTruckTax will provide an IRS stamped Schedule 1 as proof of filing your Form 2290, which will be sent to your registered email within minutes.

Step 5: Receive your Stamped Schedule 1

Within minutes of filing your Form 2290, you will receive the IRS stamped Schedule 1 in your email, confirming your successful HVUT filing. You can also access your stamped Schedule 1 anytime by logging into your ExpressTruckTax account.

Filing your annual Form 2290 does not have to be a cumbersome and time-consuming process. With ExpressTruckTax, you can efficiently file your Heavy Vehicle Use Tax, saving both time and effort. The user-friendly platform guides you through each step, ensuring accurate calculations and prompt transmission of your form to the IRS.

Stay compliant and worry-free with ExpressTruckTax, the trusted e-filing solution for truck owners and operators. Get started today and experience the ease of electronic filing with ExpressTruckTax!